Content

The newest AICPA features authored charts contrasting tax and private monetary thought conditions of your own work that have newest rules (totally free webpages registration expected). All these retired people have come to find one a social Protection money today actually what it had previously been. To put it differently, retired-worker beneficiaries is hopeful for announcements and you will/or reforms that would result in a good beefier payment.

What folks Assert

Lower than newest laws, so it deduction is set to keep phasing off, reaching 0% from the 2027. To fifty% of their pros can be taxed in the event the the mutual income is between $twenty five,one hundred thousand and you may $34,100 to possess private taxpayers, or anywhere between $32,100 and $44,100 to have married couples. The product quality deduction — the key way very taxpayers straight down their taxable earnings — gotten a boost included in the recent income tax law reputation. Withdrawn earnings (in addition to boss and you may authorities benefits) try totally taxable on detachment from the ordinary income tax costs.

Business Tax Conditions

- The law boosts the limit CTC amount to $dos,2 hundred within the 2025 and you will changes the worth of the financing for inflation moving on, when you’re tightening qualification laws and regulations.

- Even when reconciliation generally also offers an expedited procedure, it is constrained because of the Byrd Code (Section 313 of the Congressional Budget Work), that is meant to impose big limitations to the techniques.

- Our research of one’s a, the newest crappy, as well as the unappealing of your own OBBBA will bring a list of the newest law’s pros and cons in the angle out of voice taxation policy.

- Therefore, Really don’t find these becoming an extremely aren’t given work with (particularly considering the discriminatory characteristics of your own work for where those with of numerous infants rating above people who have not one, let-alone the new polarizing moniker).

- From 2029, the credit manage revert in order to $2,one hundred thousand and become detailed to own rising prices.

The guy made his Bachelor of Research from Southern area Illinois College if you are providing to your You.S. Situated in Chicago, Nick brings together his passion for finance and you will a property that have possibilities within the tax and you may bookkeeping to help members navigate advanced financial pressures. Hence, a higher withholding speed is preferred because it ensures that, at the conclusion of the entire year, the fresh withholden amount of money continue to be adequate to defense the tax responsibility as well as the rest might possibly be refunded to you. To your grounds stated a lot more than, it’s important to remember that, for the most away from taxpayers, the quantity withholden from their incentives might not become the amount your Irs helps to keep at the end of the season. To possess down earners, an excellent withholding rates out of 22% may even end up being unfairly high, providing them with the feeling you to incentives are more than-taxed and not actually worthwhile. Meanwhile, bonuses are known as supplemental wages, a totally additional category of salary that utilizes an apartment 22% withholding price, which is most definitely greater than the taxation bracket.

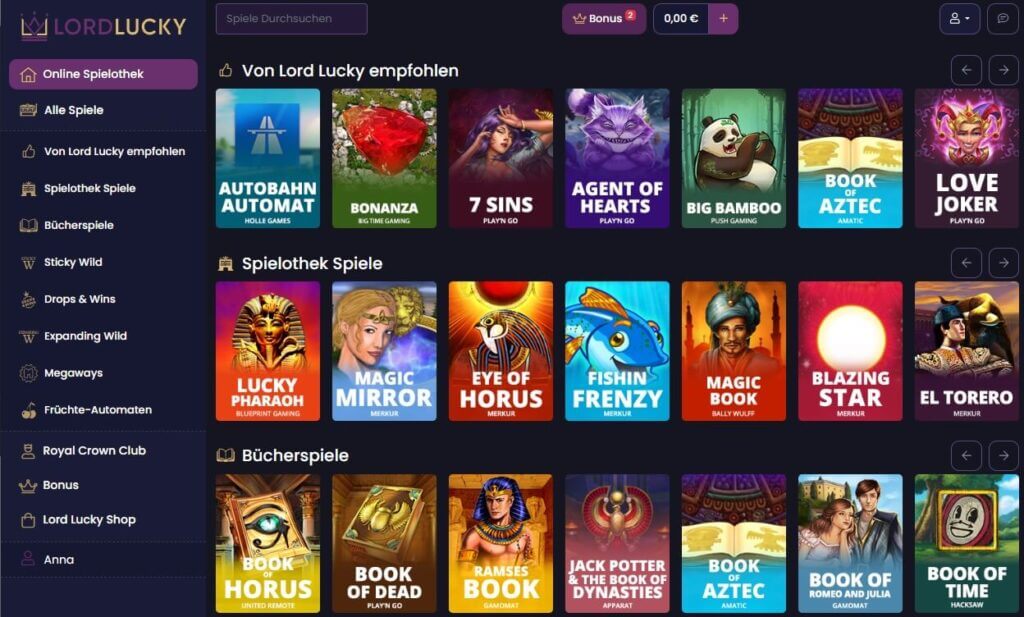

Yes, the brand new demo mirrors an entire variation inside game play, has, and you can artwork—just as opposed to real money profits. Under Area 919(g) of your Digital Fund Transfer Act, an excellent remittance import is a digital transfer from fund questioned by a transmitter to a designated receiver which is initiated because of the a good remittance transfer merchant. A great remittance transfer merchant is people or financial institution you to will bring remittance transfers to possess customers in the normal span of their company, whether the user holds an account to the financial business. The new Motley Deceive is an excellent Usa Now content spouse providing financial information, study and you may reviews built to help somebody take control of its economic existence. Taxing Personal Security professionals has become an increasingly crucial way to obtain earnings. All of us Dated-Ages, Survivors, and you can Disability Insurance coverage Believe Money Money of Income tax from Advantages Invoices analysis from the YCharts.

The additional senior deduction doesn’t apply at taxation to the Societal Defense advantages for folks and you will partners less than the individuals money thresholds, because they are actually maybe not at the mercy of levies to their benefits, Gleckman said. Societal Shelter pros are taxed based on shared earnings, and/or sum of modified happy-gambler.com Recommended Reading revenues, nontaxable focus and half of Societal Security professionals. The fresh Council away from Financial Advisors, a company in the presidential executive work environment, estimates you to changes in the new laws and regulations will help force the newest portion away from elderly people that have exemptions and deductions exceeding Social Defense earnings to 88%, away from 64% below newest rules.

Trump’s the fresh taxation deduction to have elderly people: Who qualifies and you will just what it saves

The brand new deduction levels out during the higher earnings account, and’t allege any of it for those who earn much more than $175,one hundred thousand ($250,100000 for several). Suppose an employee with a marginal income tax price of 37% (which is the large federal taxation group to possess 2024) will get an advantage well worth $step one,five-hundred,one hundred thousand. Our house has just passed The only, Huge, Breathtaking Statement Work, probably reshaping the fresh taxation surroundings for people and you may enterprises exactly the same. The newest tax legislation brings up provisions that will have extreme effects for your conclusion.

Which have vital status to Part 174 expensing, extra decline, and Area 179, so it regulations gifts each other demands and you will opportunities across the a number of of opportunities. An income tax crack on the Social Protection is not welcome lower than newest funds reconciliation laws. Only about 4% from experts just who earn lower than $twenty-five per hour also get information, the team has receive. Consequently, low-wage servers from the of a lot food you are going to qualify for the fresh taxation split, but punctual-dinner group may well not even after making comparable revenues. “A great deduction to have tipped work is in reality a pretty horrible ways to help reduced-salary professionals,” Ernie Tedeschi, the brand new movie director away from business economics at the Yale Finances Research, informed CBS MoneyWatch.

- For many years, the newest U.S. had struggled that have simple tips to lose companies that gained profits to another country.

- 3rd, the newest advised regulations particularly closes off charitable efforts as opposed to Sodium payments.

- For the reason that current email address and you will a July 3 news release, the new service told you the fresh legislation makes it thus “almost 90%” of Personal Defense beneficiaries no longer shell out federal taxes to the professionals.

- Money in a Trump account essentially can not be taken before the recipient turns 18.

- Definitely make any needed adjustments before any incentive is given out, and you will don’t hesitate to talk an income tax expert if necessary.

We’ve as well as highlighted just how such terms might or might not disagree from the House form of the bill. Larger Split provides a design you to contains 5 reels and to 15 paylines / suggests. The online game has several features in addition to Added bonus Video game, Multiplier Wilds, Discover Incentive, Retrigger, Spread out Will pay, and much more. Large Split even offers a no cost spins added bonus round and that is usually where you are able to winnings the major money. Family Republicans features expose an excellent write of their income tax proposals, which has a prospective deduction to have Public Defense readers.

In the the new bill, some of the income tax incisions is again set to expire, usually pursuing the most recent administration leaves workplace. The program, element of Trump’s “One Big Beautiful Statement,” has a great $cuatro,000 yearly taxation deduction to have seniors old 65 and you may elderly. So you can meet the requirements, solitary seniors must have a customized adjusted revenues below $75,000; married people lower than $150,one hundred thousand. The new Trump tariffs jeopardize so you can counterbalance the majority of the economic benefits of your own the fresh tax incisions, when you’re dropping lacking spending money on him or her.

Our house form of the balance would have prohibited people who own specific companies – notably service organizations such as legislation, accounting, and wellness – out of subtracting passthrough organization taxes (PTETs), however the Senate adaptation cannot. Our house adaptation do suspend the fresh capitalization and you will amortization dependence on domestic Roentgen&D expenditures paid back otherwise obtain after December 29, 2024 and you can just before January step 1, 2030. It generally does not tend to be a different supply to possess small businesses nor the newest election to help you speed the remainder amortization more a single- otherwise a few-seasons months. Of several taxation-associated proposals have been included in the nearly eight hundred-web page solution, in addition to an extension on the multiple components of Trump’s 2017 income tax getaways, set to expire at the end of this year.

Almost every other family-relevant alter were a modest boost to the son and you can dependent care and attention income tax borrowing from the bank. Similarly, the fresh TCJA enhanced the brand new thresholds from which the newest AMT different initiate so you can phase out, increasing they of $120,700 for unmarried filers and you may $160,900 to possess mutual filers in order to $500,000 to possess single filers and $1 million to own shared filers, adjusted for rising prices every year. Both the high exclusion and you will phaseout thresholds had been planned to expire after 2025, increasing the quantity of filers susceptible to the newest AMT inside the 2026.

That is distinctive from this-founded standard deduction, which is simply acceptance if you take the quality deduction. Should your reciprocal tariffs plus the Part 232 copper tariffTariffs are fees implemented from the one to nation to your merchandise imported out of a different country. Tariffs is exchange traps one to increase rates, get rid of available levels of goods and services for all of us organizations and people, and construct a financial burden to your foreign exporters. Take effect to the August step one as the booked, they will get rid of GDP from the an additional 0.step 3 percent when you are raising $401 billion inside the a lot more cash (a somewhat brief raise as the imports perform fall drastically under those people rates).

The fresh AMT is actually a vacation tax set up in the sixties to quit the newest rich from forcibly reducing their tax bill by applying tax liking issues. Under the TCJA, the brand new AMT exception number enhanced and you can is actually adjusted to possess inflation. The fresh AMT exclusion matter to possess income tax year 2025 to own single filers try $88,a hundred and you can starts to stage out during the $626,350, because the exemption number to own married people filing jointly is $137,100 and you can actually starts to stage away from the $step 1,252,700. The brand new TCJA twofold the high quality deduction quantity from the before accounts—however, which had been brief. To have 2025, the standard deduction is $15,000 for individuals and you will married people processing separately, $31,100000 to have married couples filing together, and $22,five hundred to possess brains of house.